Business Insurance in and around Hiram

One of the top small business insurance companies in Hiram, and beyond.

Helping insure small businesses since 1935

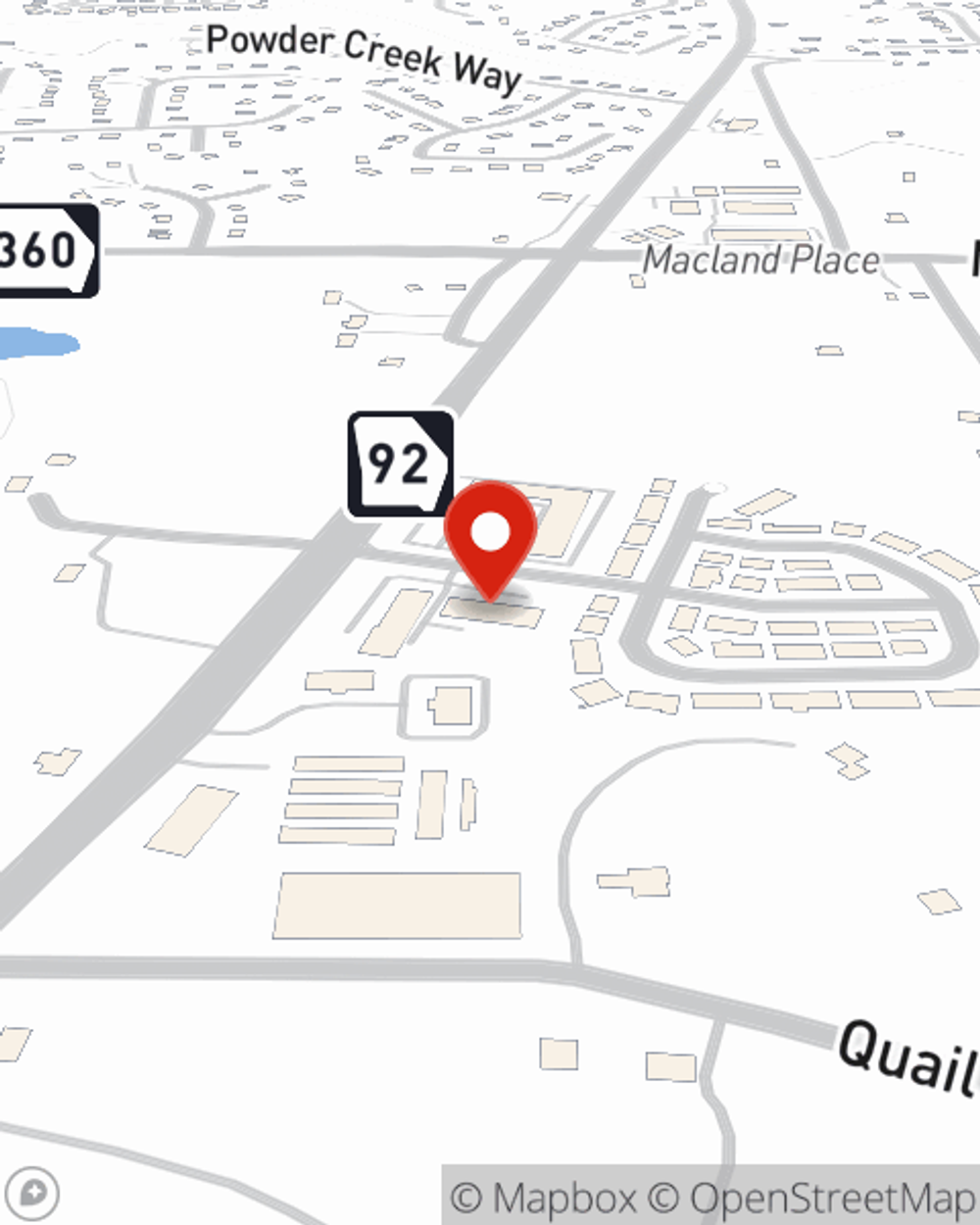

- Hwy 278 & Macland

- Paulding County

- Douglas County

- Atlanta, Ga

Insure The Business You've Built.

Operating your small business takes commitment, time, and quality insurance. That's why State Farm offers coverage options like worker's compensation for your employees, business continuity plans, errors and omissions liability, and more!

One of the top small business insurance companies in Hiram, and beyond.

Helping insure small businesses since 1935

Cover Your Business Assets

Whether you own a barber shop, a farm supply store or a donut shop, State Farm is here to help. Aside from fantastic service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Get right down to business by reaching out to agent Dave Grant's team to learn more about your options.

Simple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Dave Grant

State Farm® Insurance AgentSimple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.